Archive

Parenting After Divorce (AND during marriage!)

Today I read an Opinion piece in the New York Times, and it’s so good, I think it deserves a spot in my blog for ya’ll to read. This article is just about parenting after divorce, but gives some insight into How NOT to Get Divorced. I particularly encourage all those who have an iron grip on what they believe their “rights” are with custody. You might be cutting off your nose to spite your face.

Scars

**I owe the idea for this blog post to another “quintessential mom” I had the privilege of talking to this past week. Thanks for giving me new things to think about ;).

I got thinking about scars a few days ago. I have a few…There’s one on my right shin that I got sticking up for my little sister–the boys who had thrown her bike into the ditch pushed me in on top of it when I went in after it, cutting my shin on the fender. Another one on my right thigh is from a dog bite when I was 7 or 8. I have the faintest ever scar on my left arm, up high, from a smallpox vaccine I got when I was a baby, before my family moved to the Philippines where my dad was stationed in the Air Force. Smallpox is a live vaccine; I got one pock as a result of that. I always thought it looked kind of like a flower.

I have scars from bug bites that I had bad allergic reactions to, and a scar on my face from a staph infection that developed in what I thought was just a monster zit. It ended up having to be cut open and drained repeatedly for over a week. My hands are a map of scars, from things like cat scratches, or scrapes you get in the course of living life. And my stomach is a ridiculous mess of stretch marks–scars I got from having my first pregnancy be with twins at 22.

My twins ended up with permanent scars themselves–the older one had surgery on his skull at 6 months to open up the prematurely fused growth plate on the back right side of his head. That’s quite the scar, going from ear to ear, in a bit of an S-shape. His younger twin brother had surgery on his spine at 17; that’s a helluva scar, running from the base of his neck, almost to his waist.

My twins’ scars will NEVER go away, unlike some of mine. I was in a car accident at 15, and split my forehead open in a couple of places. You’d never tell by looking at me at this point, though, because as I grew, those scars grew with me, and are now somewhere up above my hairline. The passage of time Healed me of those scars, like it’s faded some of my other scars.

But these that I’ve mentioned are just physical scars. There are other types of scars that last a lot longer–emotional scars. The loss of dear ones can permanently scar those left behind. Anything that cuts into our souls and hearts can, and often does, leave a scar that may never fade.

It’s September again. I hate September, and it’s because of the emotional scars I’ve incurred through about 15 years worth of Septembers. Hard, painful, life-changing things seem to happen in September for me, scarring me physically AND emotionally.

Saturday morning I opened up Instagram, and the first post on my feed was about the LOTOJA race. LOTOJA is a 3 state, 206 mile, one day bike race, that starts in Logan, Utah, runs through Idaho, and ends in Jackson Hole, Wyoming. Fifteen years ago, in September, I rode that ride with 4 of my best friends. It was the culmination of a year’s worth of training, and it was one of the best days of my life, even while it was crazy hard. And the next day, my biking was over, and my sanity went into a tailspin. It was the beginning of the end of my marriage; I was divorced by the end of March 2005.

You can read other of my blog posts to find out how my divorce went for me. Suffice it to say, the emotional scars are still with me. Even after all these years, those pains are still very real, very raw–hardly healed at all, it seems. Every year when the LOTOJA comes around again, I am reminded of that scar. The bruise is still there; it still hurts to touch. That was one of the really crucial things I learned in law school working with victims of domestic abuse–the physical pains, the physical scars, they healed faster than the mental and emotional ones. Those ones linger; they stick with the victims. The hurts are deep, and the scars are permanent.

I participate in a free legal clinic at CAPSA, our local domestic violence shelter. I consulted with a woman at my last clinic who reminded me how little so much of my emotional scarring has healed. Her divorce is scarcely final; mine was final 14 years, 5 months ago. Mine still hurts like hell. So I cried with her. Big, ugly painful tears. Maybe someday those emotional scars will have grown up, out of sight, like some of my physical scars have.

I can only hope.

Joint & Separate Debts in Marriage…What ARE you on the hook for?

*This is a Utah specific post. Division of and liability for debts of married people is not the same in every state. Check your own law for how this works if you are NOT in Utah.

In UCA § 30-3-5(1)(c) it states that within a divorce decree, the court shall include provisions spelling out who is responsible to pay joint or marital debts. Joint debts would be any that you and your spouse are both signors on–the debts in both your names. It’s common for married people to have joint credit cards, both their names on car loans, mortgages, etc. “Marital” debts, however, would include those that are in just one person’s name, but the debt was for a household purpose. UCA § 30-2-5, NOT in the divorce code, but just in the section about Husband and Wife (or more appropriately now, Spouses), talks about separate debts of married people. It says:

Reality Bites.

“(1) Neither spouse is personally liable for the separate debts, obligations, or liabilities of the other:

(a) contracted or incurred before marriage;

(b) contracted or incurred during marriage, except family expenses as provided in Section 30-2-9;

(c) contracted or incurred after divorce or an order for separate maintenance under this title, except the spouse is personally liable for that portion of the expenses incurred on behalf of a minor child for reasonable and necessary medical and dental expenses, and other similar necessities as provided in a court order under Section 30-3-5, 30-4-3, or 78B-12-212, or an administrative order under Section 62A-11-326; or

(d) ordered by the court to be paid by the other spouse under Section 30-3-5 or 30-4-3 and not in conflict with Section 15-4-6.5 or 15-4-6.7.

(2) The wages, earnings, property, rents, or other income of one spouse may not be reached by a creditor of the other spouse to satisfy a debt, obligation, or liability of the other spouse, as described under Subsection (1).”

UCA § 30-2-9, referenced above, defines what a family expense is that both spouses are liable for. Family expenses “are considered expenses incurred that benefit and promote the family unit.” And a creditor can come after BOTH spouses for those, even if one’s name isn’t technically on the contract that created the financial obligation.

So let’s look at some examples of what this all means in everyday life.

Let’s say you’re married, and you buy a house with your spouse. Maybe the house title and the mortgage are only in one spouse’s name, however, for whatever reason, but you’ve both lived in it your whole married lives. You run into some financial difficulties…maybe the spouse with the mortgage in their name loses their job. Can a creditor garnish the wages of the other spouse to cover the mortgage debt?

Under Utah law, Yes. While the house is only in the name of the now-unemployed spouse, it’s arguably a family expense–both of you live there, the debt was incurred to “benefit and promote the family unit.”

So how about another example…

I’m on my second marriage. Let’s say I buy a car for my child from a previous marriage to drive. It’s never used by my spouse; he’s not on the loan, he didn’t have anything to do with the kid getting the car, the kid doesn’t live in our house with us–totally a separate thing. I have a loan on that car my kid drives. Would my husband be liable to my bank to pay that debt if I defaulted on the loan?

Under Utah law, No. That car is NOT a family expense, by definition. It was not purchased to promote the family unit, or advance a family goal. It’s a straight up separate debt.

Whose horse is it, anyway…?

You could apply the statutory definitions about joint and separate debt to credit card debts as well. A credit card just in my husband’s name that he uses to buy groceries for the family, or to pay for a family vacation, is a credit card that the creditor could come after me for if the hubby stopped making the payments. On the contrary, a credit card just in MY name, that I use for my own business expenses, or that I paid for a trip just for me with, or that I use for my own Mad Money, if you will, would be entirely MY debt obligation–the creditor can’t go after my husband for that debt if I stop paying on it.

In Utah, the big thing to consider is whether the debt has been comingled. Let’s take that house example up there, and make a few tweaks to the story. Dan buys the house when he’s still single, and lives in the house alone until he meets Doug. Doug and Dan get married, they stay in the house as a married couple for 20 years, then Dan loses his job and stops making the payments. Could the mortgagor come after Doug for payment–garnish his wages, etc? In this case, they could. Because the house has lost its separate property-ness by being used by both spouses as their marital home.

Another tweak to the story of Dan and Doug: Let’s say that Dan and Doug get married, buy a home together, and Dan moves out of his premarital home. This time, however, Dan keeps the house he had before he got married, and rents it out. So long as he doesn’t mingle the funds from the rental with the funds that are Family Funds–rent doesn’t come into a joint checking account, Dan doesn’t use money from the joint checking account to make repairs, etc.–that house of Dan’s stays his sole obligation. The mortgage company can’t garnish Doug’s wages on that house if Dan quits paying, because it’s not a family expense.

The point with all this is that it’s NOT just an issue to address in a divorce. I did a blog post recently about division of debts in divorce; THIS article is about how debts affect your married life.

Issues around money and how it’s used in a marriage are one of the leading causes of divorce. Having a little knowledge about how your spouse’s debts can impact you is important–both for your own financial stability, and for the stability of the marriage. If you and your spouse have different goals or priorities in life, and money gets involved, maybe keep an eye out to protect yourself a bit. Because nothing will blow up a marriage like losing everything you have because of a spouse’s bad financial habits…..

……or your own, for that matter.

Dealing with Debt Collectors: A Peek at the Fair Debt Collection Practices Act (FDCPA)

For the full text of the Fair Debt Collection Practices Act, see the Federal Trade Commission’s (FTC) website. This is federal law; it applies in whatever state you’re in.

When I got divorced back in 2005 I was essentially starting from less than zero. I had a few credit cards in my name, and I used those to fill in the gaps in my income. Not necessarily the wisest thing ever, but you do what you’ve gotta do when you’re in dire straits. Even after law school I struggled with debt and keeping up; I got my degree after the crash in 2008, and jobs were scarce where I needed to live. I went into private practice working for myself, but getting paid can be very hard if your clients are as broke as you are–and mine mostly were. As a result, I got behind on some of my debts.

I’m not a unique case with that. Lots of people do; and when they do, the debt collectors start coming out of the woodwork. Sometimes the debts are legitimately owed. Sometimes, though, they’re not. So how do you deal with it when they’re not–or even if they are, but you aren’t sure if the amounts are accurate, or what the terms originally were? And what do you do about the incessant calling at all hours of the day and night, or the threatening letters?

He’s outta business…

This is where the Fair Debt Collection Practices Act (FDCPA) comes into play. The FDCPA was enacted to keep debt collectors from engaging in threatening, harassing, abusive practices as they attempted to collect money from people. There are limits to the hours during the day they can call, and if/when they can call you at work, and what their communications can look like. I’ll let you read through the section about communications (§805) yourself; you need to be aware of the rules. I want to get into the part about requiring a collections agency to validate a debt, and what you should be doing when you get collection notices. That’s in §809, Validation of Debts.

You will usually get a notice in the mail that a debt has gone into collections. However, it may not have enough details for you to know exactly what debt they’re talking about, or maybe you didn’t realize the debt was owed. The notice you get MUST tell you that you have the right, within 30 days of getting the initial notice, to write and request evidence of the debt, of the name of the original creditor if the debt has been sold, anything that would support the debt collectors position that you owe money. Your job then is to write them back and request all that information. Language for your letter could look something like this:

“I received a letter from you dated (Month/Day/Year) stating I owe a debt. I AM CONTESTING THAT DEBT. Please send me any evidence you have of the debt, including copies of any contracts signed by me, the identity of the original creditor (if you don’t recognize the entity collecting the debt), and an itemized statement of the amounts you claim I owe. Please cease contacting me regarding this debt until and unless you provide this information.”

The creditor is REQUIRED BY LAW to get you the information you’ve requested about the debt. But what if what they send you STILL doesn’t prove that the debt is one you owe? For example, what if you got divorced a year ago and a creditor is coming after you for a bill your ex incurred after the divorce was final?

I had this happen to a client; this is where you have to get Tenacious.

It’s quite likely that the creditor will provide evidence that a debt is owed. You may be totally aware that there’s an outstanding debt. That is NOT evidence that YOU owe the debt. So you write back again:

“I received the documentation you sent. I AM STILL CONTESTING THIS DEBT. The evidence you provided only shows a debt is owed. It does not show that I owe this debt. Please provide me with a copy of a contract or some other agreement that I signed indicating that I agreed to pay this debt.”

This is what Tenacious looks like…

It doesn’t always get them off your back; sometimes you end up filing complaints with the FTC, the attorney general’s office in your state, the Better Business Bureau…but I’ll tell you this: In my experience, when I have contested a debt that did not belong to me, and got Tenacious, I have not ended up paying it. Ever. The creditor drops it, and they don’t ding my credit. I’m making it hard for them–it’s taking them too much time to go after me. And you know what? It’s not my job to make it easy for a creditor to collect from me when I don’t owe them anything.

They go after the low hanging fruit. I’m not a fruit. Don’t you be either.

Getting Your Debt Together: Financial Info in Divorce (& Life)

I’ve done a couple of blog posts on property and debt division in divorce (and marriage), but what if you don’t know what your debts are? It is not uncommon for one spouse to hide debts from the other, or to get credit in the other spouse’s name. Depending on the state you’re in, you might be liable for debts your spouse takes on, even if you’re NOT named as a debtor on the obligation. And maybe you don’t have that great of a handle on YOUR outstanding debt. This would be a great time to get that figured out.

Your #1 best starting place for figuring out your debt is to get copies of your credit reports from all 3 main credit bureaus in the U.S. These are Experian, Equifax, and Transunion.

The Big 3 in the U.S.

Credit bureaus keep track of your credit history–the good, the bad, and the ugly–as well as names you’ve used, employers you’ve worked for, addresses you’ve lived at, phone numbers you’ve had, etc. Any agency you’ve ever owed money to (including your cellphone provider, the power company, etc.) can report to a credit bureau how well you did at paying your bill. Your current debts will show up in your credit report–that’s the important thing for this little exercise you’ll be doing to get your financial info together.

You can request your credit report for free from all three credit bureaus once a year. The Federal Trade Commission (FTC) has a button on their website that you can click into and go through the process of getting all 3. You may be able to download a PDF of your credit report; they may require you to mail in a form to get one or all of them. I just requested all 3 of mine; 2 of them I downloaded PDFs, and one I had to fill out the form for. You CAN use one form to get all 3.

This is what the form looks like…see the middle bottom–you can select all three.

Each of the credit bureaus ask different “verifying” questions online to get your credit report. They’re making sure it’s You asking for it. Some of the questions are more involved than others (Transunion asked a question that all I could think was “HUH?”, so I marked “none of the above.” Which turned out to be the right answer.) These are usually questions about where you’ve worked or if you have or have had a loan with a particular agency at some point.

You should be keeping up with your credit report regardless of whether you’re going through a divorce or not. That’s how you make sure you’ve not been a victim of identity theft. And since all kinds of circumstances call for agencies or individuals to pull your credit (like if you’re renting a home/apartment, or trying to buy a car), it’s best to be apprised of what’s there.

There are also apps out there for your smartphone that help you keep up with your credit. CreditKarma is one; Experian even has an app. Do a search on your app store for “credit report,” and you’ll see a few different options, some for free, some paid. I have a credit card app that has the option of getting your credit score as a click button at the bottom of the screen.

If you find errors in your credit report, you can communicate with the credit bureaus to get those corrected. In my experience, that can be difficult, but you still have to use their process.

So now you know. There is no excuse NOT to get informed about your credit. Ignorance is not bliss; get your credit reports and make sure you’re not ignorant about your finances.

Websites for the three big credit bureaus are here:

Divided Debts in Divorce & Joint Creditors…Protecting your Credit Score

**This is a Utah specific post. There are different laws in other states about how creditors interact with divorced people, and there are different laws about how debt is divided and who is responsible for what, so make sure you check what the law is where you live.**

One of the big things we do when drafting a divorce is to divide up marital debt. Marital debt is all of the debt that either one of the partners has accrued during the marriage, for the benefit of the marriage. It could be in one person’s name, or both.

Yeah, it can totally feel like this…

In Utah, BOTH partners to a marriage are obligated on debts in EITHER party’s name incurred during the marriage IF the debt was for a “family expense” (see UCA 30-2-5.) Family expenses are defined at UCA 30-2-9(4), and include any expenses “incurred that benefit and promote the family unit.” Those do specifically include children’s educational expenses, like school fees, lunch money, etc, and kids’ medical and dental expenses (see UCA 30-2-5(1)(c)). Any contract entered into by one spouse in the marriage that does NOT qualify under that definition isn’t one that both parties are liable to pay. Otherwise, both spouses are on the hook. (And the separate debts thing deserves its own blog post…more on that later.)

There are some limited protections for a spouse who was not ordered to pay a debt that both parties are liable for (either because both their names are on it, or because it’s a family expense), but you’ve got to make some effort to get those protections. UCA 30-3-5 gives the divorce court authority to enter orders dividing debts in a divorce, and also explains (with UCA 15-4-6.5) what the parties need to do to make sure that they get those limited protections in place.

- The creditor must receive a copy of the decree/order that says which person is ordered to pay the debt. The statute, UCA 15-4-6.5, says “served” with a copy, so I’d do this certified return receipt at the post office if possible, or send a copy of the decree via priority mail. The point is to getting tracking information so you can prove you provided the creditor with a copy and that they received it. The divorce code says that an order requiring the person who is taking the debt to provide the creditor with a copy of the decree should be included in the decree, but honestly, I’d not trust an ex to keep creditors off my back….I’d do it myself anyway for debts that were ordered paid by the other person. (Pro Tip: I’d go to the court and get a certified copy of the decree to serve on the creditor. While you’re there, get a few certified copies. You never know when you’ll need one…)

- When you give the creditor notice, also include with that what your current mailing address is, and that of the other party. The creditor is then obligated to provide you with copies of all notices and billing statements, even if it’s not your debt to pay under the divorce decree. That keeps you informed of what’s going on with that account. Which is important, because

- A creditor cannot submit a negative report to your credit report IF they received a copy of the decree UNLESS they were sending you the notices of the account all along, including when it became delinquent, as well as the person who was supposed to be paying it. The point there is that you don’t get blindsided. You may end up having to pay the debt yourself to protect your credit score, but at least it won’t just be a huge surprise when a negative report shows up, dinging your credit. And you then file a Motion for Order to Show Cause with the court that entered your divorce decree to get the court to order your ex to pay you back what it cost you to take care of their debt. Plus your attorneys fees and court costs. (Pro Tip: Save. Everything. Get a file folder and put every document that comes to you in the mail from the creditor on that debt you aren’t supposed to have to pay. It’ll help with your Order to Show Cause, but also with your fight against the creditor if they screw up and report you to the credit bureaus without giving you notice.)

Do what you can to keep it from dragging you off the financial cliff.

So that’s the really quick and dirty story about how to protect yourself as much as you can from the other person’s court-ordered-to-pay-debts in your divorce. It’s not perfect, but it’s what we’ve got. Make sure you’re jumping through the hoops. Because trying to fight off a creditor can really suck, and so does paying your ex’s debts.

And now some Humor regarding debts…One of my favorite songs :).

Today.

Today I’m tired. I’ve been tired all week. My grandma died March 15th (The Ides!), and her funeral was last Saturday. And it was really a wonderful thing. I got to see family I haven’t seen in years; 24 of the 26 grandkids (my siblings and cousins) were there for the funeral, and it was so good to have all of them around again. The stories about her…I had no idea what an awesome young person she had been! Grandma loved flowers, and they were everywhere, and gorgeous, in her favorite colors. She had a beautiful casket with pink rose cameos on the sides…truly lovely. My grandma was 93. She had lived a very long, very full, but often very difficult, life. It was her turn to go. She was ready. And I’m happy for her.

But I’m tired. The funeral sucked the life right out of me. I cried more than I thought I had capacity to. And I’m still crying…but now it might be because my depression has punched me right in the face this week. I’m on the verge of tears constantly, for no reason. Except that my brain is Not Right. I keep doing all the things I have to do–going to work, doing my dishes, feeding my cats, making my bed, doing laundry–I even went to the gym last night–but I mostly just want to sleep this miserable Brain Fog off.

So forgive me my lack of enthusiasm and general malaise. It’s nothing personal. And I know it won’t last forever. But this week, today….My God, it feels like it will never end.

Alimony: How it “Might” be calculated

Note: THIS IS A UTAH SPECIFIC POST. The Financial Declaration that I reference in this article is the form that has been approved by the Utah courts for domestic actions in the state of Utah. Alimony calculation information is based on my experience in working Utah domestic cases, and may differ from your or another attorney’s experience.

Not that I think this in every case, but sometimes…

Alimony determination is not as cut and dried as child support calculation in Utah. Child support has an honest-to-God Calculator that the state uses to work the numbers out. Alimony doesn’t work that way. It’s generally worked out by the parties and the court, and is based on financial disclosures and the Financial Declaration that has to be submitted in all domestic cases.

In Utah, per Utah Rules of Civil Procedure Rule 26.1, parties to a domestic action must exchange Financial Declarations using the Court’s approved form. The form is NEW, EFFECTIVE FEBRUARY 25, 2019, and it was updated again in November of 2022. They’ve switched it up a little to add clarity that may have been lacking previously, and they include requiring disclosure of things like Venmo and other cash apps where you might be able to carry a balance in an account. Information about how to fill out the form, and what attachments need to be added are here. (The form itself is at the bottom of the page for that link, so scroll down.) Income amounts disclosed in the Financial Declaration are used to determine child support and alimony, and the assets information tells the court what property there is in the marriage to divide.

Ouch.

To determine alimony, the court will look at the monthly income for each party from ALL sources, the monthly budgetary needs of each party, and what the child support amount will be for the obligee parent (the one with the kids getting the payments), if the person asking for alimony includes the kids’ needs with theirs in their monthly budget. Income – Budget Needs = How Much Money is Left Over For Each Party. Alimony is appropriate if one person is doing better than the other, to some degree, and if the one who would be receiving it needs it to cover their monthly expenses. However, if your estranged spouse is making $12/hour at the convenience store, and that’s the only job they’ve ever worked, and you expect them to pay child support too, don’t count on getting alimony.

In statute, alimony is addressed at UCA 30-3-5(8) I’ve talked about these before in a blog post. The court “shall” take into consideration the factors listed in the code, including the needs of the recipient, and the ability of the payor spouse to pay, but don’t put too much stock on how much the court considers the payor’s needs–the Utah appellate court has stated that “equalization of poverty” is perfectly acceptable in making an alimony award. In those words. To quote Hansen v. Hansen, 325 P. 3d 864, 867 (UT App 2014): “We have consistently held that equalization of income — also termed ‘equalization of poverty’ — is appropriate in ‘situations in which one party does not earn enough to cover his or her demonstrated needs and the other party does not have the ability to pay enough to cover those needs.’ Sellers v. Sellers, 2010 UT App 393, ¶ 3, 246 P.3d 173….” Basically, the court has no problem forcing BOTH parties underwater, as opposed to just having one person short every month.

So now I’ve contradicted myself–I said that if your spouse can’t afford it, don’t count on getting it, and then I turned around and said the court could still order it anyway. Here’s my Real World take on the whole nasty mess: If your former spouse does not have sufficient income to pay alimony, you likely won’t get paid even if you have a court order saying you should. That’s reality. The court can talk all it wants about “equalization of poverty,” but reality is that you can’t get blood from a turnip. So keep that in mind, because none of the judges that deal with these alimony cases have to live with the judgment; it’s YOUR life that is going to be in constant conflict if you insist on an alimony award that your ex cannot pay.

Bottom line: Be realistic. Be sensible. And don’t lie on your Financial Declaration just so you can get alimony, or get out of paying alimony. I believe the Ghost of Alimony Awards Past will haunt you forever if you do. And you’ll deserve it.

Child Support: How it’s Calculated (Utah Specific)

Child support calculation can be a bit of a mystery to those who haven’t had to deal with it before. And honestly, that means just about anyone who’s not had a family case. In Utah–and LET ME BE TOTALLY CLEAR ON THIS: I’M JUST TALKING ABOUT UTAH–the income numbers used are whatever your gross income is on a 40 hour a week job, if you’re a W-2 employee. The gross income number is different if you’re self-employed, so we’ll get to that in a different post.

The Office of Recovery Services has included a child support calculator on its website, which you can find here. This is what the calculator on the website looks like:

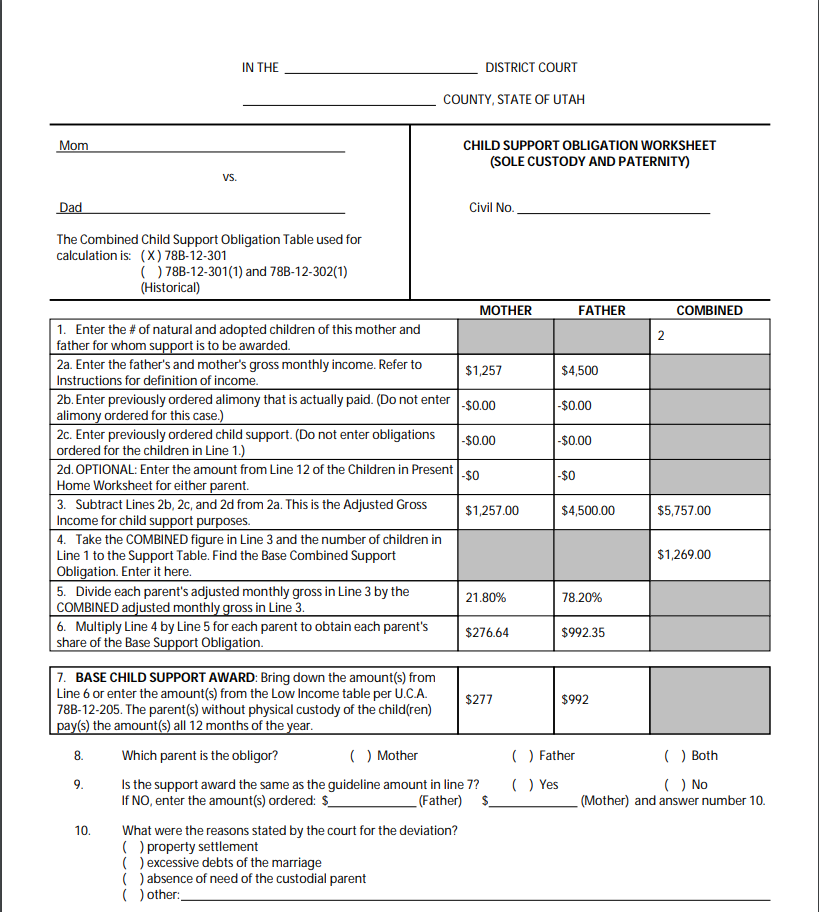

You input the names of the parents, the number of kids, the number of overnights (if you’re doing a joint physical custody plan), income of the parents, push the button, and TaDa, you have a child support worksheet printed out that you can file with your documents, like this:

And now the details:

Your income that you input is for one months’ worth of one 40-hour per week job, UNLESS you have ALWAYS worked overtime or ALWAYS get a big bonus at the end of the year.

- If you’re a normal, 9 to 5 worker, who doesn’t get bonuses/work overtime/have pay variations, you take the number of paydays you have per year, multiply the gross amount from ONE pay period by that many paydays, divide it by 12, and that’s your monthly income. For example: Say I gross $1000 per paycheck. I get paid every other week–which comes out to 26 paychecks per year. My total yearly gross income is $26,000.00. Divide that total amount by 12 months in a year, and my gross monthly income that I’d put in for myself on the child support calculator is $2,167 (we round to the nearest dollar, which in this case means rounding Up.)

- OR, take your hourly rate, multiply that by 40, multiply that by 52, divide by 12, and that’s your monthly income. For example: $12/hr x 40 (hours per week)=$480/per week, x 52(weeks)=$24,960(per year) / 12(months)=$2,080/month.

- If you get paid once a month, you use the amount of your gross income for one month, so long as there aren’t any big variations month to month on your income. If there are, add up the 12 gross amounts of those paychecks, divide by 12, and that’s your monthly income.

- If you get paid twice monthly without pay variations, add up all of them for the year (all 24) and divide by 12. That factors in the shorter month of February, but spreads that shorter month’s pay out over the year.

- If you’re one of those people who get bonuses every year, you’ll need to use your gross income tax that’s reported on your yearly tax return. You’ll divide that number by 12, and that’s your monthly gross income.

You do the same for the other party. That’s their gross monthly income that you input into the child support calculator.

If one parent has not been regularly employed, or has not been employed full-time outside the home (as in the case of a stay-at-home parent), the court will “impute” that parent at a minimum wage income. That means that the court assumes that unless you are permanently disabled either mentally or physically, a stay at home parent could conceivably at least work at a minimum wage job. Whether that’s realistic or not is something you might end up arguing in court, but minimum wage is the standard for a parent who hasn’t previously worked. The UNLESS, here, is Unless that unemployed parent had been employed prior to being married, or had received special training or education at some point prior to or during the marriage, and could theoretically find work at a rate higher than minimum wage with that skill set.

Minimum wage is roughly $1,257.00 per month gross (rounding up, per U.C.A. 78B-12-205(8), though it doesn’t make any difference in the child support amounts to round up minimum wage–we’re just going for consistency here.)

In our sample worksheet picture, above, you see that child support calculation takes into account BOTH parents’ incomes. (Our sample puts Mom at minimum wage, and Dad is set at a roughly $26 per hr wage. ) The monthly incomes are added together, the state’s algorithm is applied to determine how much of that total would theoretically be spent to support children if the parents were together, and then each party’s percent contributed to the total is determined. Each parent is responsible for their portion of this total amount in child support–which means that the parent that the children do NOT live with full time pays their portion (in this example, $992.00) to the other parent, who doesn’t actually pay anything out to anyone else (unless you count the landlord, the power company, school lunch, etc.)

That’s the basic child support calculation. There are other circumstances that the calculator takes into account, however–joint physical custody, for example. Or split custody (each parent has at least one child living full time with them), or if one of the parties already has a prior court order requiring them to pay child support or alimony to another person. Or if a parent has other children at home that they’re supporting. Those circumstances will reduce the amount of income a parent is required to put into the “pot”, so to speak, of what the total income amounts are that are considered for the current child support order. For example:

If you look at 2d in the picture above, you see a number that Mom’s income is being reduced by as a result of her having 1 child in her household that she’s supporting that’s not part of the child support order we’re working through. You can run that calculator with the parent being single, or the parent being remarried. If the parent is remarried, then the current spouse’s income is taken into account to determine how much the parent would be “paying” in child support to take care of the kids in the parent’s current household–something of a legal fiction there, since Mom in this example isn’t actually “paying” anything. The point is to not take away from kids living in Mom’s household (or Dad’s, as the case may be).

If you have a straight up custodial/non-custodial parent time situation, you don’t need to enter the number of overnights. If you have parents in a joint physical custody situation, however, you do need to. It changes the child support numbers–not always by a lot, but it does make a difference. Joint physical custody is any parent time schedule that has one parent having at least 111 overnights–the other parent would then have 254, as we’re looking at overnights in an average year (no, we’re not counting Leap Year overnights). The new joint physical custody parent time statute, UCA 30-3-35.1, puts the parents at 145 and 220 overnights, respectively. Using our same income amounts and plugging the overnights into the calculator, we get this:

Go ahead and run numbers yourself. You can play with the split custody, overnights, income amounts, other kids in the house, etc…..there are a lot of variations in people’s different circumstances, and the calculator does a pretty good job with keeping up with those circumstances and making it easier to determine what child support will be.

Child support is not like alimony–there IS a number that applies to your situation, and it’s NOT generally negotiable…at least insofar as the court is concerned. But there are legitimate variables, so make sure that you’re running the right calculator for your situation.

…and it’s That Time of Year again

For whatever holidays you celebrate this winter…Have a Happy one.

I post every year about the holidays and parent time, and though I’ve said it before, I’m gonna say it again: Please, for the sake of your own peace and sanity and that of your children, behave yourself during the holiday parent time designations and exchanges. It takes little more than putting yourself in the place of your child to see why this is important. And think back to your own childhood–was it a good one? Was it bad? And WHY? Do you remember the holidays being a wonderful, exciting time that you got to spend with family? Or do you remember your parents jerking you around while they tried to “get back at” each other? What kind of holiday season do you want for YOUR children?

I had a really wonderful childhood. My parents are still married; they like each other, even. And they really love us kids. We could feel it. Even when we were dirt poor, the holidays always felt special and magical and Safe. And Peaceful. My children have not had the benefit of having parents who are not divorced, but they HAVE had the benefit of parents who have NOT used them as pawns to get back at each other for real or perceived offenses, particularly during the holidays. Because I DO want my kids to have had a great childhood, my and their father’s decisions not withstanding.

Your children did not choose your divorce. Please don’t make them pay for it, especially at this time of the year.

(For the holiday parent time schedule in Utah, see my blog post with it spelled out, or UCA 30-3-35.)