Archive

It's the End of the World As We Know It…

*Updates to the courts procedure while we’re going through this COVID-19 thing can be found at this link, which is to the Utah Courts webpage for updates.

Ok, so not really. It IS the end of the world as we know it for at least a few weeks to months. I’m avoiding Facebook, etc., myself, because I had been before (depression + Facebook=kill me now, most of the time) but it’s even worse now. My family is basically prepared. When the store shelves cleared immediately of toilet paper and water, I had a dozen and a half or so rolls, and kept wondering who these weird people were who thought a pandemic was the equivalent of an earthquake, and that our city water would suddenly become contaminated and undrinkable.

That’s not how pandemics work, ya’ll. That’s how earthquakes work (which as a sidenote, actually happened this morning early in the Salt Lake Valley, so maybe those folks are glad they bought up all the water…more about THAT here.).

Anyway. The beauty of my job is that I really CAN do it anywhere there’s an internet connection, and on Monday, I dragged my desktop home from my day job, and got myself set up to work from home for the next few weeks. I love working from home. As an anxious depressive, getting out of bed in the morning is excruciating, especially knowing I’ll have to, like, put on pants and makeup and not look like a slob and stuff. These past couple of days, I have literally dragged myself out of bed, put on my bathrobe, and sat down at my computer at 8am. No makeup required. No pants required. That’s straight up perfection, my friends.

It’s also really fantastic that most of us really DO have technology literally at our fingertips that allows for all kinds of communication without having to be WITH anyone. My smartphone has face to face calling (Facetime because it’s an Apple, but Skype and Facebook Messenger do the same thing). I can text if I don’t feel like talking. I can receive and send email from my phone as well. And so can 95% of the world’s population (that’s totally a guess. I have no data to support that percentage.)

The population that I’M speaking to now, though, you folks in Utah, you who are scared or confused about the legal system, who are afraid to leave your homes, but afraid to not be able to leave your homes, I’m still here for you. I’ve been doing a lot of family law legal consulting. For those who would qualify for CAPSA’s services, I do it for free. For those of you who actually CAN pay some legal fees, I charge $75/hr, which I can take through Venmo or Paypal or Square on a credit card. You CAN still talk to a lawyer–I can Facetime/etc with you. Or you can email.

The point here is this: Don’t feel like you’re stuck in a situation that you don’t want to be in because you don’t have access to any legal counsel. I’m available virtually by appointment (which you can make by emailing me–see my About tab at the top of this page). Or you can just email if you have a specific question. A lot of your FAQ’s are already answered on my blog here…just go to the “search” box at the top right of the page, and type in a keyword you need info on, and everything I’ve written about that topic will come up. Hell, if push came to shove, the courts are still open, and I can e-file any case documents for a legal case I’m working on, without having to leave my home office. (I actually HAVE completed entire cases without ever traveling to a courthouse.)

So keep that in mind. Don’t panic. It may be the End of the World as We Know It, but You Can Still Feel Fine ;).

Scars

**I owe the idea for this blog post to another “quintessential mom” I had the privilege of talking to this past week. Thanks for giving me new things to think about ;).

I got thinking about scars a few days ago. I have a few…There’s one on my right shin that I got sticking up for my little sister–the boys who had thrown her bike into the ditch pushed me in on top of it when I went in after it, cutting my shin on the fender. Another one on my right thigh is from a dog bite when I was 7 or 8. I have the faintest ever scar on my left arm, up high, from a smallpox vaccine I got when I was a baby, before my family moved to the Philippines where my dad was stationed in the Air Force. Smallpox is a live vaccine; I got one pock as a result of that. I always thought it looked kind of like a flower.

I have scars from bug bites that I had bad allergic reactions to, and a scar on my face from a staph infection that developed in what I thought was just a monster zit. It ended up having to be cut open and drained repeatedly for over a week. My hands are a map of scars, from things like cat scratches, or scrapes you get in the course of living life. And my stomach is a ridiculous mess of stretch marks–scars I got from having my first pregnancy be with twins at 22.

My twins ended up with permanent scars themselves–the older one had surgery on his skull at 6 months to open up the prematurely fused growth plate on the back right side of his head. That’s quite the scar, going from ear to ear, in a bit of an S-shape. His younger twin brother had surgery on his spine at 17; that’s a helluva scar, running from the base of his neck, almost to his waist.

My twins’ scars will NEVER go away, unlike some of mine. I was in a car accident at 15, and split my forehead open in a couple of places. You’d never tell by looking at me at this point, though, because as I grew, those scars grew with me, and are now somewhere up above my hairline. The passage of time Healed me of those scars, like it’s faded some of my other scars.

But these that I’ve mentioned are just physical scars. There are other types of scars that last a lot longer–emotional scars. The loss of dear ones can permanently scar those left behind. Anything that cuts into our souls and hearts can, and often does, leave a scar that may never fade.

It’s September again. I hate September, and it’s because of the emotional scars I’ve incurred through about 15 years worth of Septembers. Hard, painful, life-changing things seem to happen in September for me, scarring me physically AND emotionally.

Saturday morning I opened up Instagram, and the first post on my feed was about the LOTOJA race. LOTOJA is a 3 state, 206 mile, one day bike race, that starts in Logan, Utah, runs through Idaho, and ends in Jackson Hole, Wyoming. Fifteen years ago, in September, I rode that ride with 4 of my best friends. It was the culmination of a year’s worth of training, and it was one of the best days of my life, even while it was crazy hard. And the next day, my biking was over, and my sanity went into a tailspin. It was the beginning of the end of my marriage; I was divorced by the end of March 2005.

You can read other of my blog posts to find out how my divorce went for me. Suffice it to say, the emotional scars are still with me. Even after all these years, those pains are still very real, very raw–hardly healed at all, it seems. Every year when the LOTOJA comes around again, I am reminded of that scar. The bruise is still there; it still hurts to touch. That was one of the really crucial things I learned in law school working with victims of domestic abuse–the physical pains, the physical scars, they healed faster than the mental and emotional ones. Those ones linger; they stick with the victims. The hurts are deep, and the scars are permanent.

I participate in a free legal clinic at CAPSA, our local domestic violence shelter. I consulted with a woman at my last clinic who reminded me how little so much of my emotional scarring has healed. Her divorce is scarcely final; mine was final 14 years, 5 months ago. Mine still hurts like hell. So I cried with her. Big, ugly painful tears. Maybe someday those emotional scars will have grown up, out of sight, like some of my physical scars have.

I can only hope.

Back to School!

I’ve been divorced over 14 years now. My baby was 2 when I stopped living with him; my ex moved away from where I’d lived with my kids, into different school boundaries, 3 or 4 years later. My children went from going to schools where the staff knew me, and knew who I was, to schools that didn’t know my ex was even divorced.

What difference does that make anyway? Well, for starters, there are all these forms that parents fill out at our annual school registrations/Back to School nights, or when they register kids in a new school for the first time. Included in the information a parent provides is the name/identity of both parents. Divorced parents typically have to provide evidence that they have physical custody of kids, and that the parent is entitled to enroll the kids in that school.

But what if the district doesn’t KNOW the parents are divorced? What if the custodial parent represents to the school that a step parent is a legal guardian/legal parent/The Mom (specifically in our culture with how we give kids dad’s last name), and doesn’t mention the other legal parent at all? The school likely will not know that there IS another parent who is entitled to information about the kids, or to pick the kids up at school, or Any of That.

Let me just tell you right now, up front, before school registration stuff has happened, how to avoid a fight and be a Decent Human who co-parents appropriately:

- Do not list your new spouse as the other Parent on the registration forms. Unless your new spouse has legally adopted your children, they are NOT a legal “parent” such that they are entitled to be listed as a Parent. They can be listed as an emergency contact, as an Other individual who can get information about the kids, but they are not the Parent.

To break that down into super-understandable language: “Mom” on the form is the Mom who was the Mom listed in the divorce; “Dad” on the form is the Dad who was the Dad listed in the divorce. That’s who you put in those spaces on the registration form. Period.

This is ESPECIALLY true if the other parent has joint legal custody of your child(ren). “Joint legal custody” means that even if the kids don’t live full time with that parent, that parent is STILL a legal guardian, entitled to information about the kids from the school, the doctor, the church, whatever, without having to go through you. - As the super intuitive follow up to #1, DO list your ex spouse as the other Parent on the form when you’re filling it out. Put their name, address, email, phone number, all of it. This way the school is aware of who they are, and can provide that parent information directly (in the case of shared legal custody), rather than going through you, when asked for it.

- Provide the school with a copy of your custody order that shows who has legal and physical custody of your kids.

- If you have sole legal AND physical custody of your children, STILL put the other parent in the “dad” or “mom” spot on the form, but make note that the other parent is not entitled to info, etc., without your permission… and provide a copy of your custody Order to back up that assertion. You can then put the step parent in the space of Other contact, as someone who can pick up the kids at school, get info from the school, etc., on your behalf. You are doing this because even if you have sole legal custody of your kids, your new spouse is NOT a legal guardian of those children. You can delegate these types of parenting duties, depending on your state/jurisdiction, but simply marrying a Dad doesn’t make you The Mom, and vice versa.

And there you have it–how to be a Good Co-Parent, and not get in a fight on the first day of school (or after, when it’s found out that you did something creepy, mean, and underhanded to your ex, that’s NOT in the best interest of your kids).

If you are the non-custodial (or less than sole custodian) of your kids, and if your ex is a SHITTY co-parent, and refuses to provide the school with your name and status as a parent, this is what can be done to remedy the situation:

- Go to the school office during school hours. Ask to speak with the principal or a school counselor. (Pro-tip: Call ahead and make an appointment so they’ll be there, ready to talk to you, when you show up.)

- You will bring with you: A copy of your court-signed custody order showing you have joint custody of some sort; your drivers license; your children’s birth certificates; AND if you’ve changed your name, you should also bring a copy of YOUR birth certificate, AND a certified copy of your court order for your legal name change.

- Explain to the principal or counselor that you are a legal guardian of your children, and request that they provide information to you as needed to help you support and parent your children. You’ll provide them with copies of all the documents you brought so they can keep those in the kid’s file(s) at school and know going forward how your situation works.

Repeat this process at every school any of your children attend–the elementary, the junior high/middle school, the high school. The schools don’t necessarily communicate amongst themselves, even in the same school district, and as long as you’ve already got everything collected in one place for the process (and probably already took time off work, etc), you might as well get it done all at once. Besides that, then the school administrators have met you in person, they know you’re on the up and up, and they will be more likely to help you help your kids in the future.

And this is the part where I IMPLORE PARENTS TO BE GOOD CO-PARENTS AND NOT JERK AROUND THE OTHER PARENT JUST BECAUSE YOU’RE A JERK. My kids have had a stepmother for 14 of the 14 1/2 years I’ve been divorced. I totally get how the dynamics of a blended family work, and how divorced parents interact. Your children are better off with ALL of their parents–legal and step–working together. Don’t cut out the other legal parent for the sake of your own ego, or because you don’t think they’re important. They are… Just ask your kids.

The QDRO: NOT the Horror Story You Think It Is

*At the outset, I should say that QDRO’s CAN be a tricky, but only insofar as there are rules that have to be followed, and they don’t actually apply to all the different types of retirement plans that are out there. And if you have a lot of different financial assets, or a bunch of different retirement accounts, or have a super complicated algorithm you’ve agreed to to calculate how much each person is getting, you’ll be dealing with a much more involved process. But for the rest of us, the thing that MOST affects the complexity is waiting for years to file one. But let’s not get ahead of ourselves…

~~ALSO–This article is not intended to substitute for legal advice. It is for information ONLY. Consult with an attorney in your jurisdiction for legal advice.~~

“QDRO” is an acronym for the term Qualified Domestic Relations Order. If you’ve been through a divorce where a retirement plan was divided as property, you’ve probably heard the term (though you may not have known what it meant.) Federal law was enacted decades ago to prevent a worker’s retirement funds from being garnished or otherwise taken away from that person, strictly because it diminished the person’s financial security after they retire (and could lead them to being dependent on government programs.) That law is found at Title 29 of the United States Code, Chapter 18. It’s called ERISA (Employee Retirement Income Security Act). Under ERISA, certain plan retirement accounts cannot be garnished, assigned, or otherwise “alienated” from the person who owns the account under the plan. EXCEPT. Except when there is a division of the account in a divorce, and ONLY if a Qualified Domestic Relations Order has been entered.

There is a difference between a “Qualified” Domestic Relations Order and a Domestic Relations Order. QDROs only apply to ERISA retirement plans. I don’t want to get into the weeds too much on what makes a retirement plan ERISA qualified (mostly because that’s really not my area of expertise). But as a general statement, the types of plans that are covered under ERISA are non-government pension plans, profit sharing plans, 401(k) plans, and certain employee stock ownership plans. The one most people will be dealing with is the 401(k).

So what are the Magic Legal Words you have to use to make a QDRO actually “qualified”? In a nutshell:

- The Order must clearly state the name and last known mailing address of the plan participant AND the name and last known mailing address of the Alternate Payee. And you MUST use that term—Alternate Payee—to describe the person who is getting a portion of the account funds.

- It must state the amount of money that’s being awarded to the Alternate Payee, OR

- It must clearly state how that amount is to be determined. (For Example: One half of the funds that existed in the account as of the date of divorce, or one half of the value of the account, less amounts that existed in the account as of the date of the marriage, with the date of marriage provided in the QDRO.)

- The Order must state how many payments are to be made to the Alternate Payee, or what time period the Order applies to.

And

- It has to specifically state what plan the Order applies to (Like “ABC Company 401(k) Plan”).

Notice that if the Order is making a division based on a calculation that you don’t have to actually do the math in the Order. The plan administrator does that for you; you just need to be totally clear on how it’s to be calculated. This is generally stated in the divorce decree, so you’d just need to copy the instructions from the decree into the QDRO document.

ALSO—to be “qualified,” the Order MUST NOT

- Require the plan to distribute any benefit that wouldn’t actually be available to the plan participant under the plan (like, it can’t say that the alternate payee gets payments from the plan before the participant would be allowed under the terms that already exist.)

- It can’t require the plan to pay out more money than it’s actually valued at (for instance, it can’t give someone $10,000 if the account is only worth $7,000.)

And

- It can’t assign benefits to a new alternate payee that were already assigned to a DIFFERENT alternate payee (think: second marriage/divorce, and the retirement account was already divided with the first wife…second wife doesn’t get ½ of the total, because ½ of the total is already first wife’s. Second wife could only get ½ of the husband’s portion that’s still in the account.)

It’s also a good idea to include the last four digits of the plan participant’s and alternate payee’s social security numbers and/or birthdates, just to clarify WHO these people are. And you need to state that the QDRO is being entered pursuant to a domestic relations order that was entered in a court with jurisdiction to make the division, and what the date of divorce is.

So you’ll need to wait to finalize the divorce before you prepare your QDRO, but you should NOT wait too long. See, that’s one of the things that really makes these more complex.

Let’s say that you’re divorced on October 1, 2019. The divorce says you’re entitled to ½ of the value of the account as of the date of divorce. So what happens if you wait 5 years file your QDRO, and in the meantime, the plan participant took a loan against the account, and now the total value is less than your half would’ve been as of the date you got divorced? You are still entitled to your half of the account as it existed on October 1, 2019, but how do you expect to get it? OR, you’re entitled to ½ of the value of the account as of the date of the divorce, plus any losses or gains that it’s experienced up until the date the account is divided….but the account has lost half of its value by the time you file the QDRO 10 years later (like when the market crashed in 2008, for example.) You just lost a huge chunk of what you’d have been entitled to but for your taking a decade to get the QDRO done. Or if there were gains…calculating the gains would be as to your portion only, not your ex’s. See? Much less straightforward.

So as far as actually preparing the QDRO goes, it’s not rocket science. Here’s an example of some basic language that would work to make your “domestic relations order” a “qualified” one (The Magic Legal Words):

- Parties: The parties hereto were husband and wife, and a divorce action is in this Court at the above case number. This Court has personal jurisdiction over the parties. The parties were married on [DATE], and divorced on [DATE the court signed the Decree].

- Participant Information: The name, last known address, social security number, and date of birth of the plan “Participant” are: [Name], [Address]; [social security number]; [birthdate].

- Alternate Payee Information: The name, last known address, social security number, and birth date of “Alternate Payee” are: [Name], [Address]; [social security #]; [birthdate].

- The Alternate Payee is the spouse or former spouse of the Participant. The Alternate Payee shall have the duty to notify the plan in writing of any changes in mailing address subsequent to the entry of this Order.

- Plan Name: The name of the Plan to which this Order applies is the [Name of the 401(k) plan] (hereinafter referred to as “Plan”), administered by [Company].

- Any changes in Plan Sponsor or name of the Plan shall not affect Alternate Payee’s rights as stipulated under this Order.

- Effect of this Order as a Qualified Domestic Relations Order: This Order creates and recognizes the existence of an Alternate Payee’s right to receive a portion of the Participant’s benefits payable under an employer-sponsored defined contribution plan that is qualified under Section 401(k) of the Internal Revenue Code (the “Code”). It is intended to constitute a Qualified Domestic Relations Order (“QDRO”) under Section 414(p) of the Code and Section 206(d)(3) of ERISA and the Retirement Equity Act of 1984, P.L. 98-397.

- Pursuant to State Domestic Relations Law: This Order is entered pursuant to the authority granted in the applicable domestic relations laws of Utah.

- Provisions of Marital Property Rights: This Order relates to the provision of marital property rights as a result of the Decree of Divorce between the Participant and the Alternate Payee.

- Amount of Alternate Payee’s Benefit [this paragraph should be customized to reflect the Decree as ordered in the parties’ case.]

- Commencement Date and Form of Payment to Alternate Payee: If the Alternate Payee so elects, the benefits shall be paid to the Alternate Payee as soon as administratively feasible following the date this Order is approved as a QDRO by the Plan, or at the earliest dated permitted under the terms of the Plan Benefits will be payable to the Alternate Payee in any form or permissible option otherwise available to participants under the terms of the Plan, except a joint and survivor annuity.

- Alternate Payee’s Rights and Privileges: On and after the date that this Order is deemed to be a QDRO, but before the Alternate Payee receives a total distribution under the Plan, the Alternate Payee shall be entitled to all of the rights and election privileges that are afforded to Plan beneficiaries, including, but not limited to, the rules regarding the right to designate a beneficiary for death benefit purposes and the right to direct Plan investments, only to the extent permitted under the provisions of the Plan.

- Death of Alternate Payee: [It’s a good idea to address what happens to the alternate payee’s portion if they die before all the funds are distributed].

- Death of Participant: [Spell out who gets the funds if the participant dies before they’re all distributed].

- Savings Clause: This Order is not intended, and shall not be construed in such a manner as to require the Plan:

- to provide any type or form of benefits or any option not otherwise provided under the Plan;

- to provide increased benefits to the Alternate Payee;

- to pay any benefits to the Alternate Payee which are required to be paid to another alternate payee under another order previously determined to be a QDRO; or

- to make any payment or take any action which is inconsistent with any federal or state law, rule, regulation or applicable judicial decision.

_____________________________________________________________________________________

I recognize that that language probably looks like just so much Gibberish to some–which would seem to make QDROs super hard to put together. HOWEVER, in my practice, I found that a LOT of companies that had employee retirement plans that could be divided by a QDRO already had their own QDRO template that they liked to use. I could contact the company’s plan administrator and ask them to email me a copy (or in the Bad Old Days, mail me a hardcopy I could then copy and type up), and it would have all of this information in it already, with all the Magic Legal Words & Phrases. I just needed to put in the specifics of the case I was working on. Generally they’d want to get a copy of the court-signed Divorce Decree before sending me the template, which is another reason you need to wait until the divorce is finalized to prep your QDRO.

Obviously there’s more to QDROs and separating out retirement accounts that exists in practice. But truly, if you use the terms required (or the template the plan administrator sent you), and get it done soon after the divorce is final, you’ve won half the battle. If your attorney tells you that they’re going to charge you a ton of money for a QDRO for a super-basic, one ERISA qualified retirement account division, maybe give it a try yourself. You don’t have to be an attorney to get the Magic Legal Words included in the Order…You just need to know what they are.

P.S.

To Note: NOT covered under ERISA are state and federal retirement/pension plans, military retirement, severance package type private employer benefits, and IRAs (Individual Retirement Accounts). YOU DO NOT USE A QDRO TO DIVIDE THESE NON-ERISA PLANS. They have their own types of forms/Orders, so don’t try to use a QDRO to divide them. I found that the State of Utah had a packet with information and a template to give instructions on dividing their state retirement plans, so again, it doesn’t have to be a horror story.

PPS.

For a bit more information on this topic, check out the IRS website, here: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-qdro-qualified-domestic-relations-order

and from the Department of Labor, here: https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/qdro-overview.pdf

Life Insurance in Divorce Actions

In my time as a family law lawyer, I saw a lot of divorce petitions that requested my client (usually the husband) carry a life insurance policy for the benefit of opposing party after the divorce. I hate those clauses myself. I think once you’re divorced, you’re Not Married, and therefore neither party should be required to support an ex-spouse after they die. Hard pass. But that doesn’t mean that people remember to change the beneficiary on their life insurance policy after a divorce is finalized, so…..what then? Wouldn’t that end up giving the ex-spouse the benefit of the policy after the parties aren’t married anymore?

In my time as a family law lawyer, I saw a lot of divorce petitions that requested my client (usually the husband) carry a life insurance policy for the benefit of opposing party after the divorce. I hate those clauses myself. I think once you’re divorced, you’re Not Married, and therefore neither party should be required to support an ex-spouse after they die. Hard pass. But that doesn’t mean that people remember to change the beneficiary on their life insurance policy after a divorce is finalized, so…..what then? Wouldn’t that end up giving the ex-spouse the benefit of the policy after the parties aren’t married anymore?

In Utah, that’s a No. With an Unless….

At UCA 75-2-804(2), which is part of the Utah probate code, it says that “[e]xcept as provided by the express terms of a governing instrument, a court order, or a contract relating to the division of the marital estate made between the divorced individuals before or after the marriage, divorce, or annulment, the divorce or annulment of a marriage,” the spouse as beneficiary is automatically dropped when the divorce is final. (emphasis added) That language in quotes up there is the actual statutory language. What it means is that it has to be expressly stated that the ex spouse will remain the beneficiary, either in a “governing instrument”–part of the life insurance policy, either in the policy itself or in a document referred to by the policy–or in a court order. If not, the ex is automatically dropped as a beneficiary in the event of a divorce.

There have been a couple of Utah appellate court cases that have addressed what all that means. The first one, which was decided in 2012, is Malloy v. Malloy, 283 P.3d 597 (UT App 2012). In Malloy, the fight was between a former Mrs. Malloy and a more recent Mrs. Malloy, Mary Beth and Rhonda, respectively. Mary Beth and Dan Malloy had been married first. Dan got a life insurance policy through the Federal Employees Group Life Insurance (FEGLI). He named Mary Beth as the beneficiary on it. They got divorced, and Dan married Rhonda.

Dan never changed his beneficiary on his FEGLI policy. Dan then dies. Mary Beth was sent his death benefit through his life insurance policy. Rhonda sued Mary Beth, saying she was the wife when Dan died, and she should get the proceeds from his life insurance. Mary Beth won. The court explained why. The FEGLI policy, in a document that was referred to and incorporated in the policy itself, said specifically that divorce would NOT automatically drop the beneficiary (ex) spouse from getting the death benefit; that the policy holder had to make the change themselves on purpose. The court said that constituted “express terms” under the UCA 75-2-804. Ex-wife therefore got the death benefit, because Dan hadn’t specifically made the change before he died.

Fast forward 5 years, to 2017, and the next time this issue came up in the Utah appellate court. This time it was the Utah Supreme Court that addressed the issue, in a case called Hertzske v. Snyder, 390 P.3d 307 (UT 2017). In this case, Snyder was the (now) ex-wife. She married Edward Hertzske, father of the Plaintiff, Tyler Hertzske. While life was good between Snyder and Hertzske Sr., Hertzske Sr. took out a life insurance policy on himself for $500,000 and made Snyder the beneficiary, with Tyler listed as the contingent beneficiary. Later on Snyder and Hertzske Sr. divorced. Hertzske Sr. apparently didn’t like Snyder At All at that point. He even changed his will saying he wanted to disinherit her in any and all ways possible, but he never changed the beneficiary on his life insurance policy. Hertzske Sr. subsequently died.

The lawsuit was over who got the $500k from the life insurance policy–Snyder or Tyler. The divorce didn’t address the life insurance policy at all; and the policy language was kind of vague about how beneficiaries are changed–it didn’t say anything about how or if a divorce would change the beneficiary. Definitely nothing “express” as required by Utah law.

The court said that it was necessary to interpret how UCA 75-2-804 interacted with UCA 30-3-5(1)(e), which is part of the divorce code. We already looked at what 75- says, above. UCA 30-3-5(1)(e) says that the court “shall” include language in the divorce decree “if either party owns a life insurance policy or an annuity contract, an acknowledgment by the court that the owner: has reviewed and updated, where appropriate, the list of beneficiaries; has affirmed that those listed as beneficiaries are in fact the intended beneficiaries after the divorce becomes final; and understands that if no changes are made to the policy or contract, the beneficiaries currently listed will receive any funds paid by the insurance company under the terms of the policy or contract.”

The upshot was that the court concluded that if a person wanted their ex-spouse to still be the beneficiary on a life insurance policy after the divorce was final, that the language in UCA 30-3-5(1)(e) HAD to be included in the divorce. End of story. And if it’s not, then UCA 75-2-804 applies. Because if there was some other way of interpreting it, then the legislature would have created statute that was unnecessary, and they don’t do that.

The court said that since Snyder and Hertzske Sr.’s divorce didn’t have the statutory language from UCA 30-3-5(1)(3), Snyder, the ex-wife, didn’t get the $500k. And since Tyler was the next in line for it under the life insurance policy as the contingent beneficiary, he should receive his father’s life insurance payout. (Which honestly only seems right.)

The moral of the story, then, is this: In Utah, unless it is expressly stated with the language from the divorce code in the divorce decree itself, OR the life insurance policy says expressly that the beneficiary will NOT change after a divorce automatically, exes are automatically bumped from being beneficiaries on the others’ life insurance policies when a divorce is final.

Now you know.

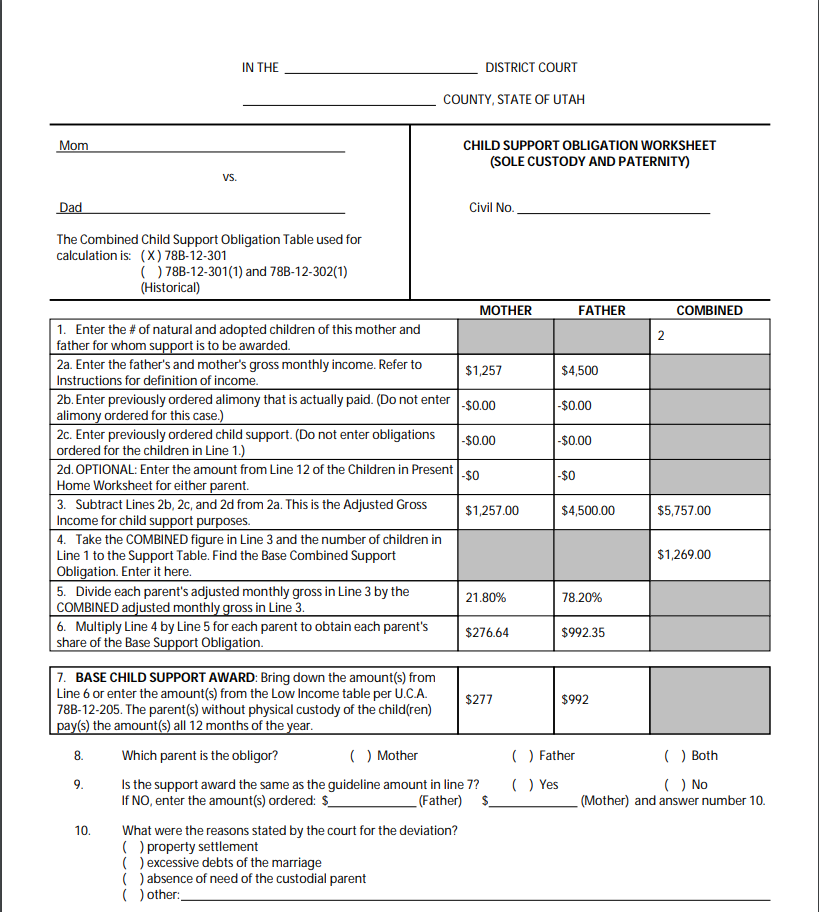

Child Support: How it’s Calculated (Utah Specific)

Child support calculation can be a bit of a mystery to those who haven’t had to deal with it before. And honestly, that means just about anyone who’s not had a family case. In Utah–and LET ME BE TOTALLY CLEAR ON THIS: I’M JUST TALKING ABOUT UTAH–the income numbers used are whatever your gross income is on a 40 hour a week job, if you’re a W-2 employee. The gross income number is different if you’re self-employed, so we’ll get to that in a different post.

The Office of Recovery Services has included a child support calculator on its website, which you can find here. This is what the calculator on the website looks like:

You input the names of the parents, the number of kids, the number of overnights (if you’re doing a joint physical custody plan), income of the parents, push the button, and TaDa, you have a child support worksheet printed out that you can file with your documents, like this:

And now the details:

Your income that you input is for one months’ worth of one 40-hour per week job, UNLESS you have ALWAYS worked overtime or ALWAYS get a big bonus at the end of the year.

- If you’re a normal, 9 to 5 worker, who doesn’t get bonuses/work overtime/have pay variations, you take the number of paydays you have per year, multiply the gross amount from ONE pay period by that many paydays, divide it by 12, and that’s your monthly income. For example: Say I gross $1000 per paycheck. I get paid every other week–which comes out to 26 paychecks per year. My total yearly gross income is $26,000.00. Divide that total amount by 12 months in a year, and my gross monthly income that I’d put in for myself on the child support calculator is $2,167 (we round to the nearest dollar, which in this case means rounding Up.)

- OR, take your hourly rate, multiply that by 40, multiply that by 52, divide by 12, and that’s your monthly income. For example: $12/hr x 40 (hours per week)=$480/per week, x 52(weeks)=$24,960(per year) / 12(months)=$2,080/month.

- If you get paid once a month, you use the amount of your gross income for one month, so long as there aren’t any big variations month to month on your income. If there are, add up the 12 gross amounts of those paychecks, divide by 12, and that’s your monthly income.

- If you get paid twice monthly without pay variations, add up all of them for the year (all 24) and divide by 12. That factors in the shorter month of February, but spreads that shorter month’s pay out over the year.

- If you’re one of those people who get bonuses every year, you’ll need to use your gross income tax that’s reported on your yearly tax return. You’ll divide that number by 12, and that’s your monthly gross income.

You do the same for the other party. That’s their gross monthly income that you input into the child support calculator.

If one parent has not been regularly employed, or has not been employed full-time outside the home (as in the case of a stay-at-home parent), the court will “impute” that parent at a minimum wage income. That means that the court assumes that unless you are permanently disabled either mentally or physically, a stay at home parent could conceivably at least work at a minimum wage job. Whether that’s realistic or not is something you might end up arguing in court, but minimum wage is the standard for a parent who hasn’t previously worked. The UNLESS, here, is Unless that unemployed parent had been employed prior to being married, or had received special training or education at some point prior to or during the marriage, and could theoretically find work at a rate higher than minimum wage with that skill set.

Minimum wage is roughly $1,257.00 per month gross (rounding up, per U.C.A. 78B-12-205(8), though it doesn’t make any difference in the child support amounts to round up minimum wage–we’re just going for consistency here.)

In our sample worksheet picture, above, you see that child support calculation takes into account BOTH parents’ incomes. (Our sample puts Mom at minimum wage, and Dad is set at a roughly $26 per hr wage. ) The monthly incomes are added together, the state’s algorithm is applied to determine how much of that total would theoretically be spent to support children if the parents were together, and then each party’s percent contributed to the total is determined. Each parent is responsible for their portion of this total amount in child support–which means that the parent that the children do NOT live with full time pays their portion (in this example, $992.00) to the other parent, who doesn’t actually pay anything out to anyone else (unless you count the landlord, the power company, school lunch, etc.)

That’s the basic child support calculation. There are other circumstances that the calculator takes into account, however–joint physical custody, for example. Or split custody (each parent has at least one child living full time with them), or if one of the parties already has a prior court order requiring them to pay child support or alimony to another person. Or if a parent has other children at home that they’re supporting. Those circumstances will reduce the amount of income a parent is required to put into the “pot”, so to speak, of what the total income amounts are that are considered for the current child support order. For example:

If you look at 2d in the picture above, you see a number that Mom’s income is being reduced by as a result of her having 1 child in her household that she’s supporting that’s not part of the child support order we’re working through. You can run that calculator with the parent being single, or the parent being remarried. If the parent is remarried, then the current spouse’s income is taken into account to determine how much the parent would be “paying” in child support to take care of the kids in the parent’s current household–something of a legal fiction there, since Mom in this example isn’t actually “paying” anything. The point is to not take away from kids living in Mom’s household (or Dad’s, as the case may be).

If you have a straight up custodial/non-custodial parent time situation, you don’t need to enter the number of overnights. If you have parents in a joint physical custody situation, however, you do need to. It changes the child support numbers–not always by a lot, but it does make a difference. Joint physical custody is any parent time schedule that has one parent having at least 111 overnights–the other parent would then have 254, as we’re looking at overnights in an average year (no, we’re not counting Leap Year overnights). The new joint physical custody parent time statute, UCA 30-3-35.1, puts the parents at 145 and 220 overnights, respectively. Using our same income amounts and plugging the overnights into the calculator, we get this:

Go ahead and run numbers yourself. You can play with the split custody, overnights, income amounts, other kids in the house, etc…..there are a lot of variations in people’s different circumstances, and the calculator does a pretty good job with keeping up with those circumstances and making it easier to determine what child support will be.

Child support is not like alimony–there IS a number that applies to your situation, and it’s NOT generally negotiable…at least insofar as the court is concerned. But there are legitimate variables, so make sure that you’re running the right calculator for your situation.

…and it’s That Time of Year again

For whatever holidays you celebrate this winter…Have a Happy one.

I post every year about the holidays and parent time, and though I’ve said it before, I’m gonna say it again: Please, for the sake of your own peace and sanity and that of your children, behave yourself during the holiday parent time designations and exchanges. It takes little more than putting yourself in the place of your child to see why this is important. And think back to your own childhood–was it a good one? Was it bad? And WHY? Do you remember the holidays being a wonderful, exciting time that you got to spend with family? Or do you remember your parents jerking you around while they tried to “get back at” each other? What kind of holiday season do you want for YOUR children?

I had a really wonderful childhood. My parents are still married; they like each other, even. And they really love us kids. We could feel it. Even when we were dirt poor, the holidays always felt special and magical and Safe. And Peaceful. My children have not had the benefit of having parents who are not divorced, but they HAVE had the benefit of parents who have NOT used them as pawns to get back at each other for real or perceived offenses, particularly during the holidays. Because I DO want my kids to have had a great childhood, my and their father’s decisions not withstanding.

Your children did not choose your divorce. Please don’t make them pay for it, especially at this time of the year.

(For the holiday parent time schedule in Utah, see my blog post with it spelled out, or UCA 30-3-35.)

Useful New Blog I’m Linking To

I came upon a useful new blog today while reading a very interesting article on protective orders and what constitutes violating one in this age of online appearances, social media platforms, and etcetera. (That article is here.) The new blog is called Technology Safety, and there is a link to it on the right side of this page, under My Links. There is a lot of good information there regarding ways to stay safe with all of the new technological advances that make spying on/stalking someone so much easier. Check it out.

Protective Orders: What They’re NOT for

While I’m not in private practice anymore, I do take the occasional one-off type thing: those cases that will have a one time court appearance or are strictly consulting, or are basic estate planning–that sort of thing. Today I had a hearing defending a client in a motion for a permanent protective order.

I truly believe in protective orders. When they are needed, one should ABSOLUTELY get one. That said, I ALSO feel strongly that protective orders should not be abused. If one is simply trying to control another person, or force a custody order, or simply to “get back” at another person for some perceived slight, getting a protective order is absolutely inappropriate. Personally, I think people who get ex parte protective orders for the wrong reasons should have to pay the other person’s costs and attorneys fees when the motion and temporary PO are dismissed. And maybe have some sort of sanction thrown at them by the court, like being ordered to do community service.

My client this morning who I was defending was in a situation where the protective order was being used as a tool to try and control and manipulate him. The Petitioner in this case, his baby mama, was not in need of protection by the court. They’re not even Utah residents–they’ve both been living in California up until she took off and came back to Utah, taking their tiny baby daughter with her. He filed for custody in California a week or so after she left, when it became apparent that she couldn’t be trusted to allow him contact with his child. And 3 weeks later, after dodging–but finally being served– with the California court papers, Baby Mama filed for a protective order.

Long story short, I won this one. The protective order motion was denied, and the ex parte/temporary order was dismissed. The reason I won is because my client was excellent at documenting stuff–he saved all the texts, emails, and Facebook messages the two had exchanged. And he was totally upfront with his less-than-perfect behaviors. He had also not been abusive to her–in fact, SHE had assaulted HIM; SHE had been the one threatening HIM. And in the end, we were able to prove that Baby Mama did not meet the requirements to get a protective order against my client.

Gifts from my client :). He was very grateful, and very nice. The best kind of client to have.

I like to win. A lot. And when that win can knock down what I see as abuse of protective orders, and protect a person from losing constitutional rights in a quasi-criminal action, all the better. I hate people who cry wolf. They truly degrade the value of the protective order, which hurts everyone out there who honest to God needs one.

From the Archives: February 29, 2012

**I wrote the bit below in 2012, just 2 years after I graduated from law school, a mere 7 years after my divorce was final. It took a lot of years to get to the point where I wasn’t just continually emotionally ambushed by the most innocuous things. To all of you who are in that place still, know that there will be an Other Side. The pain subsides; you will be able to draw breath again without agony.

March

It’s late on Wednesday, and I was just thinking I’d do myself a favor and go to bed early, and passed the calendar in the kitchen and thought, “Well, I’ll just be an over-achiever and change it over to March before it’s like the 5th of March” and I did, and there, on the 16th, written in black sharpie marker in 8-year old handwriting is “Jackson’s B-day.” And I burst into tears. Jackson is my baby. He is 9 on the 16th, and he clearly wanted to make sure I remember :). I will NEVER forget.

Jacks was 2 years old and 1 day when my ex and I signed our stipulated agreement for divorce. I signed, even though I was signing away my life, even though it was NOT fair at all, because I needed out before I had to kill myself. I couldn’t be married to him for one more second. And he punished me for it to the enth degree.

The ex took everything–EVERYTHING. Including my babies; including my Jacks. March is a killer month for me. There is not enough Vitamin D, Omega-3 fatty acids, not enough melatonin or xanax to ease the pain of March.

“Beware the Ides of March.” That’s what my grandma told me when I was pregnant with Jackson–he was due the 15th, the Ides. Had I known what was in store for me over the course of the years, I would have saved us all some time listening to me bitching and moaning, and all the tears and misery, and swallowed all those sleeping pills like I REALLY wanted to back then. I didn’t. Now I can’t. Just gotta suck it up for one more March….

P.S. I love my baby! He’s WONDERFUL! Might be the smartest almost-9 year old on the planet :).